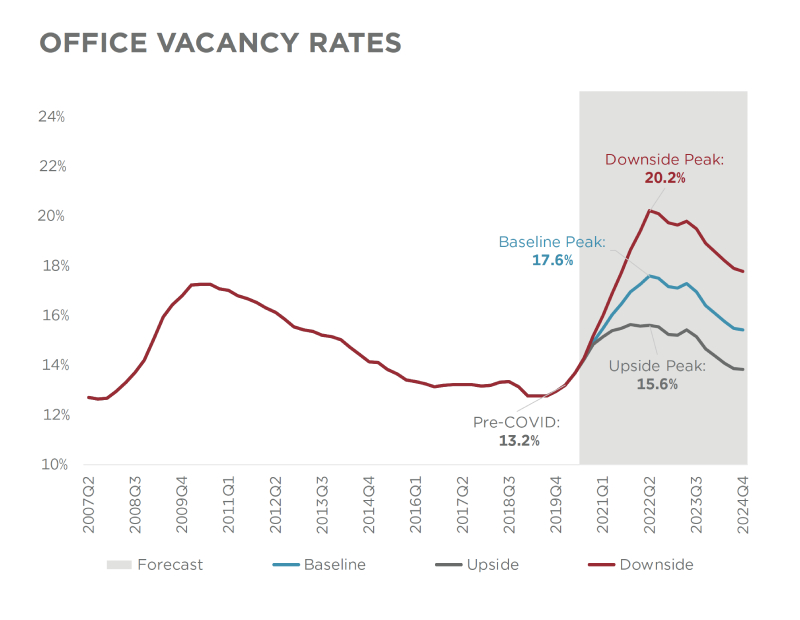

Office vacancy rates have surged dramatically, raising concerns about their broader implications on the U.S. economy. With urban office spaces remaining underutilized in a post-pandemic landscape, some major cities report vacancy levels between 12% and an alarming 23%. This downturn not only affects property values but also poses significant risks to the banking sector, particularly against the backdrop of maturing commercial real estate loans. Experts warn that the economic impact of these high vacancy rates could reverberate through various financial institutions, potentially leading to widespread delinquencies. As the Federal Reserve grapples with interest rate policies, the real estate market trends could dictate the financial stability of many banks and the general health of the economy at large.

The current situation surrounding unoccupied commercial properties necessitates a closer look at the fallout from elevated office vacancy levels. As businesses adapt to new working models, there’s a pressing need to evaluate how these trends affect the landscape of urban hubs. Rising rates of empty office buildings not only influence real estate investments but also highlight vulnerabilities within financial frameworks, with banks facing exposure to commercial real estate loans. Understanding the interplay of economic indicators and banking sector risks becomes crucial for forecasting potential challenges ahead. This unfolding scenario underscores the necessity for strategic responses to mitigate adverse effects on market stability.

The Impact of High Office Vacancy Rates on the Economy

High office vacancy rates in major U.S. cities have emerged as a concerning trend in the commercial real estate sector, particularly following the pandemic. Current vacancy rates ranging from 12% to 23% reflect a significant drop in demand for office space, which has far-reaching implications. These fluctuating rates not only place downward pressure on property values but also highlight the potential for economic destabilization. Analysts suggest that diminished occupancy in office buildings could lead to reduced business activity, ultimately affecting local economies and potentially stalling broader economic recovery.

As businesses shift towards remote and hybrid work models, the fade in need for physical office spaces has raised alarms within the real estate market. The economic impact of vacancy rates is not isolated to real estate stakeholders but may ripple through various sectors, affecting suppliers and service providers who rely on foot traffic and occupancy rates. This risk is heightened in a climate where many commercial real estate loans are due in the coming years, intertwining the fate of the real estate market with the overall health of the banking sector and, by extension, the U.S. economy.

Frequently Asked Questions

What are the current office vacancy rates in major U.S. cities and how are they impacting the economy?

Office vacancy rates in major U.S. cities range from 12% to 23%, significantly affecting property values and overall economic stability. High vacancy rates indicate a decreased demand for office spaces, which can lead to declining commercial real estate values and economic challenges.

How could rising office vacancy rates affect commercial real estate loans?

Rising office vacancy rates can impact commercial real estate loans by increasing the likelihood of delinquencies among property owners unable to cover their mortgage payments. As vacancy rates rise, property values decline, making it harder for borrowers to refinance or sell, thus heightening risks for lenders.

What role do office vacancy rates play in the banking sector risks?

High office vacancy rates present significant risks for banks, particularly regional institutions heavily invested in commercial real estate. A surge in vacancies can lead to financial stress as borrowers default on loans, potentially resulting in significant losses within the banking sector.

What economic impact do high office vacancy rates have on the U.S. economy?

High office vacancy rates can dampen economic growth by reducing spending in the commercial real estate sector, leading to lower property tax revenues, job losses in construction, and reduced consumer confidence, which could ultimately slow down broader economic activity.

How do shifting real estate market trends influence office vacancy rates?

Shifting real estate market trends, such as increased remote work and changing business needs, heavily influence office vacancy rates. As companies adapt to new operational models, demand for traditional office spaces decreases, contributing to higher vacancy rates.

In what ways could the economic impact of vacancy rates result in bank failures?

The economic impact of high vacancy rates could lead to bank failures if a significant number of commercial real estate loans default. This domino effect can strain financial institutions that are heavily leveraged in commercial property, potentially leading to a liquidity crisis.

What strategies are being considered to mitigate the effects of high office vacancy rates on commercial real estate?

Mitigation strategies for high office vacancy rates include repurposing vacant properties for alternative uses, enhancing property amenities to attract tenants, and cities potentially reforming zoning laws to facilitate conversions of office buildings into residential spaces.

What is the outlook for office vacancy rates and their influence on commercial real estate trends?

The outlook for office vacancy rates remains uncertain, influenced by remote work trends and economic conditions. While some experts anticipate a gradual stabilization, ongoing challenges in the commercial real estate sector could hinder recovery and impact future trends.

How might a decline in office vacancy rates benefit the economy?

A decline in office vacancy rates could revitalize the economy by increasing demand for office space, enhancing property values, boosting tax revenues for local governments, and promoting job growth in related sectors, leading to overall economic improvement.

What are the key factors driving changes in office vacancy rates today?

Key factors driving changes in office vacancy rates include the shift to remote and hybrid work models, the economic recovery post-pandemic, interest rates, and evolving corporate strategies towards office space utilization.

| Key Point | Details |

|---|---|

| Current Office Vacancy Rates | In major U.S. cities, vacancy rates range from 12% to 23%. |

| Impact on Property Values | High vacancy rates are depressing property values significantly. |

| Commercial Real Estate Debt | 20% of the $4.7 trillion in commercial mortgage debt comes due this year. |

| Expert Opinion | Kenneth Rogoff believes losses in commercial real estate won’t cause a full-blown financial crisis but will impact many investors. |

| Bank Vulnerabilities | Small and medium-sized banks are at higher risk due to fewer regulations compared to larger banks. |

| Future Predictions | Despite the current situation, optimism exists that interest rates will stabilize in the long term. |

Summary

Office vacancy rates are currently a critical issue impacting the economy. With vacancy rates reaching between 12% and 23% in major U.S. cities, there are significant implications for property values and the financial health of businesses dependent on commercial real estate. Experts warn that while the situation is concerning, it does not necessarily foreshadow a complete economic meltdown, particularly for larger banks that are better regulated. However, small to medium-sized banks may struggle as a wave of commercial real estate loans matures. Overall, while there are risks, the context of a robust job market and booming stock market mitigates some immediate concerns surrounding office vacancy rates.